I don’t “play the market.” I am not an individual stock market investor and I don’t really follow it closely. But my 401(k), what I am depending upon to feed, clothe, and house me now that I’m retired, has my life savings tied to stock market performance.

I don’t “play the market.” I am not an individual stock market investor and I don’t really follow it closely. But my 401(k), what I am depending upon to feed, clothe, and house me now that I’m retired, has my life savings tied to stock market performance.

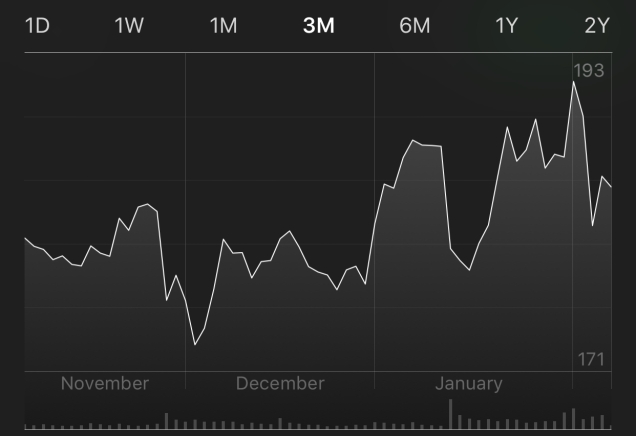

All I do know is that my “portfolio” has gained significantly over the past year as the Dow Jones Industrial Average (whatever that is) has soared. But then on Friday the market dropped by 666 points. And again on Monday, the market plummeted by 1,175 points, the largest one day drop in history.

All kinds of financial pundits on TV were attempting to explain what the hell was going on. It’s a “market correction” some said. Others feared that the market bubble had burst. Still others said “keep calm and carry on,” saying that it is just part of the normal ups and downs of the stock market.

But now I’m bewildered.

What should I do? Should I cash out my 401(k) and put my money in a bank? Or stuff it in my mattress? Or should I just ride it out? I don’t know.

As I write this, the stock market is up almost 255 points since its opening this morning. I don’t know what being up 255 points really means, but I guess it’s better than being down by 255 points.

All that matters to me is that I continue to have the funds to feed, clothe, and house me until my bubble personal bursts for the last time.

Written for today’s one-word prompt, “bewildered.”

The Central bank is basically trying everything to keep the markets afloat. I fear by April the situation would be much worst.

LikeLiked by 2 people

I hope you’re wrong. I don’t want to have to come out of retirement if the market tanks.

LikeLiked by 1 person

Let’s see Sensei, let’s pray the Chinese housing bubble doesn’t burst. But speaking from the stats it’s not looking good.

LikeLiked by 1 person

So many people will be able to relate to this. The scariest part is that the market gurus don’t know nearly as much as they want us to think they do. The market is driven by human whims, not anything like the “rational” homo economicus they want us to believe is in charge.

LikeLiked by 1 person

It’s true. Every “expert” has a different take on what makes the market tick and why it does what it does.

LikeLiked by 1 person

It is impossible to tell, but don’t sell NOW. If you don’t need the money right this very minute, let it ride and get some GOOD advice and where your money belongs.

LikeLiked by 3 people

I don’t plan to bail. At least not yet.

LikeLike

My advise to you is to stop micro managing your portfolio minute by minute, and I know its not my money its urs but ride it out and know that the American Economy is the wordless greatest and strongest because of its fundamental solid regulations and ethical base. If you don’t believe me, check out Warren Buffett he always says, “It’s never paid to bet against America. We come through things, but its not always a smooth ride” WB

LikeLiked by 3 people

I am going to stay put and ride it out and hope that you and Warren Buffett are right.

LikeLiked by 2 people

Long term investment will not disappoint you even in current situation. but the traders need be more cautious.

LikeLiked by 3 people

Selling stocks is a tricky business. For me, I try to sell when the stock reaches its peak value, and buy at the minimum. The market will always have huge fluctuations, you just got to ride them not let them carry you.

LikeLiked by 1 person

“Buy low, sell high.” Yep, that works as long as the market continues to go up. But, you’re right. If it crashes, best to just hold on and not panic. It will come back…eventually.

LikeLiked by 1 person

100% agree. People who sell when the market crashes are not making the correct choice. After every crash, the market comes back up.

LikeLiked by 1 person

“1,175 points, the largest one day drop in history.”

It seems like a big number, and I’m not saying it isn’t, but the Dow 10 years ago was about half of what it is today. Percentage wise it’s probably aligned with other big drops in the past.

If the past 90 years say anything, the overall American stock market will be significantly higher in the long term.

LikeLiked by 1 person